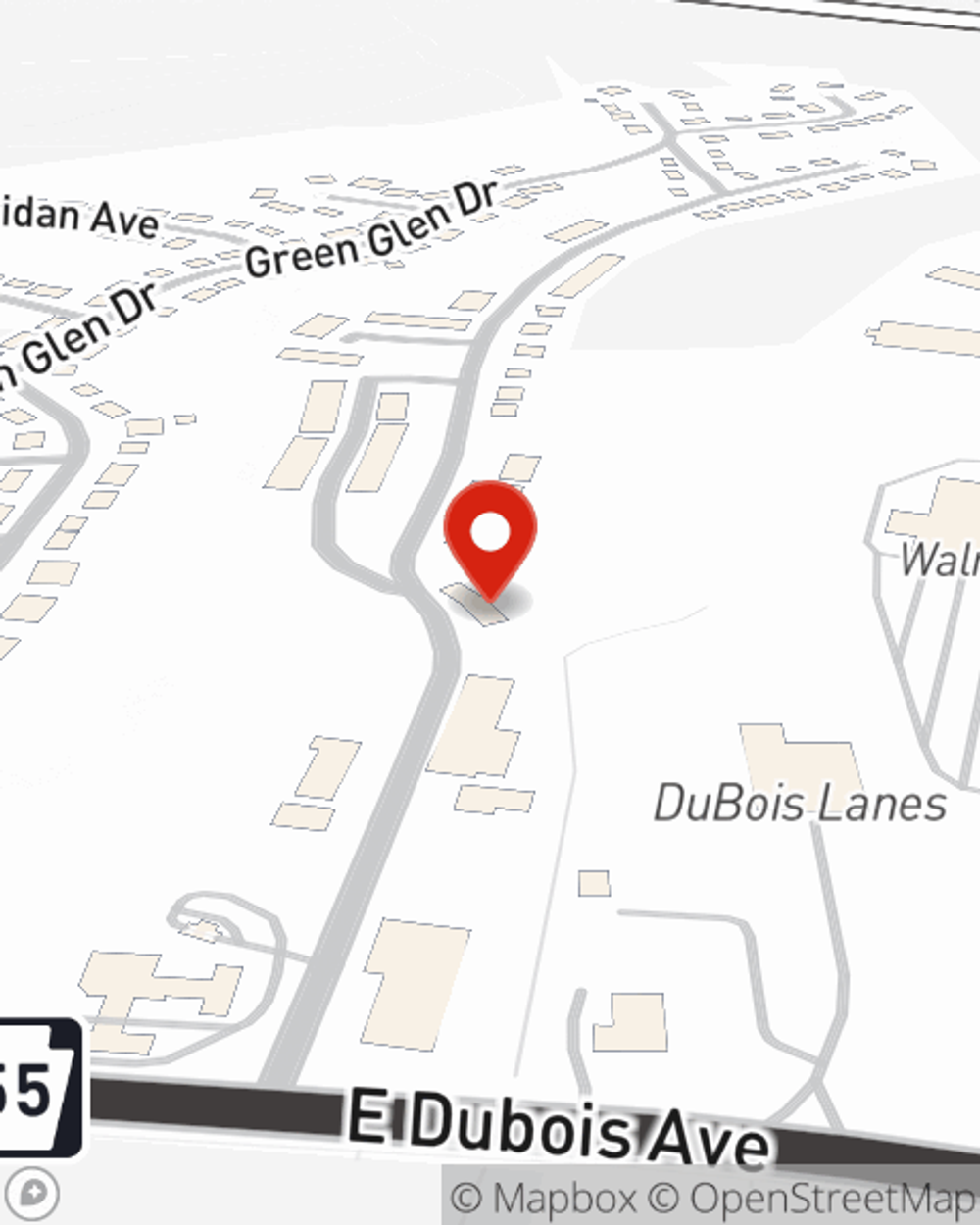

Business Insurance in and around Dubois

One of Dubois’s top choices for small business insurance.

No funny business here

- DuBois

- Reynoldsville

- Sykesville

- Falls Creek

- Brockway

- Brockport

- Stump Creek

- Treasure Lake

- Sandy Twp

- Clearfield

- Penfield

- Big Run

- Punxsutawney

- Brookville

- Rockton

- Union Twp

- Luthersburg

- Curwensville

- Grampian

- Woodland

- Clearfield County

- Jefferson County

- Elk County

- Clarion County

This Coverage Is Worth It.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes catastrophes like an employee getting hurt can happen on your business's property.

One of Dubois’s top choices for small business insurance.

No funny business here

Insurance Designed For Small Business

Protecting your business from these possible catastrophes is as easy as choosing State Farm. With this small business insurance, agent Kim McDonald can not only help you devise a policy that will fit your needs, but can also help you submit a claim should an issue like this arise.

Don’t let worries about your business stress you out! Visit State Farm agent Kim McDonald today, and explore the advantages of State Farm small business insurance.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Kim McDonald

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.